The Fed Now “Holds” 4X as Much US Bond Debt as China Does

$4.5 trillion in US treasuries has already been monetized, $2 trillion in just the last 12 months

Editor’s note: $4.5 trillion in US treasuries has already been monetized, $2 trillion in just the last 12 months — supposedly this doesn’t matter because the Fed is supposedly going to shrink its (fictitous) balance sheet again, but it’ll never happen. It’ll just go up and up.

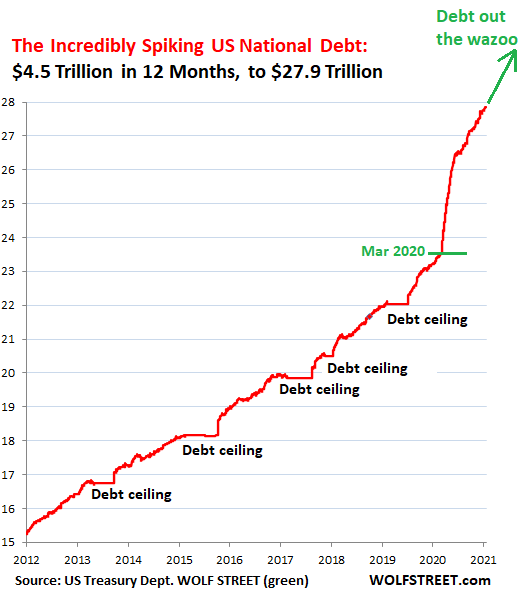

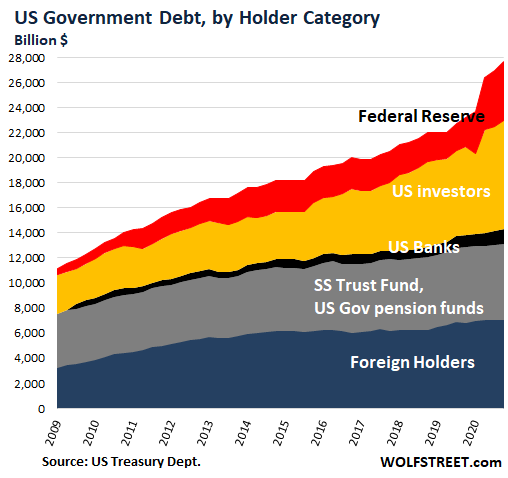

Driven by stimulus and bailouts, and fired up by the tax cuts and by grease and pork, the Incredibly Spiking US National Debt has skyrocketed by $4.55 trillion in 12 months, to $27.86 trillion, after having already spiked by $1.4 trillion in the prior 12 months, which had been the Good Times. These trillions are all Treasury securities that form the US national debt, and someone had to buy every single one of these securities:

So we’ll piece together who bought those trillions of dollars in Treasury Securities that have whooshed by over the past 12 months.

Tuesday afternoon, the Treasury Department released the Treasury International Capital data through December 31 which shows the foreign holders of the US debt. From the Fed’s balance sheet, we can see what the Fed bought. From the Federal Reserve Board of Governors bank balance-sheet data, we can see what the banks bought. And from the Treasury Department’s data on Treasury securities, we can see what US government entities bought.

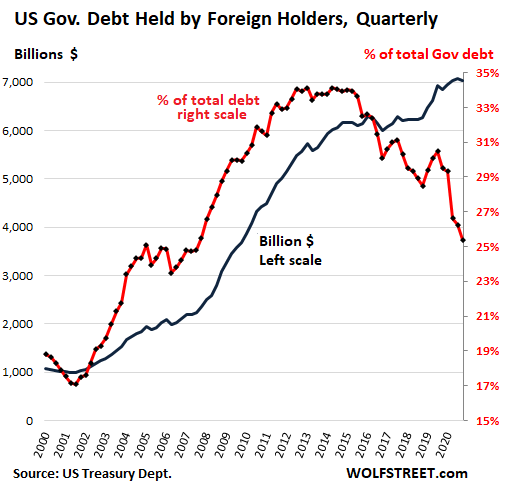

Share of foreign holders falls to 25% for first time since 2007:

In the fourth quarter, foreign central banks, foreign government entities, and foreign private-sector entities such as companies, banks, bond funds, and individuals, reduced their holdings by $35 billion from the third quarter, to $7.04 trillion. This was still up from a year ago by $192 billion (blue line, right scale in the chart below). But their share of the Incredibly Spiking US National Debt fell to 25.4%, the lowest since 2007 (red line, right scale):

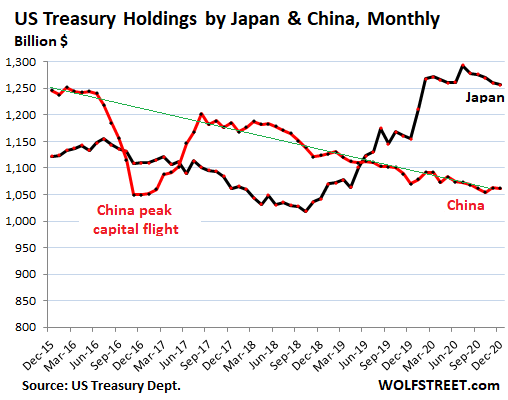

Japan (blue line), the largest foreign creditor of the US, reduced its holdings in Q4 by $20 billion, to $1.26 trillion. But compared to a year earlier, its holdings were still up by $102 billion.

China (red line) continued on trend, gradually reducing its holdings. In Q4, its holdings ticked down just a tad, and over the 12-month period fell by $8 billion, to $1.06 trillion:

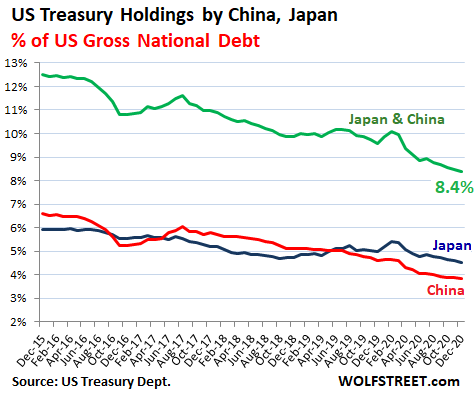

Japan’s and China’s relative importance in the Incredibly Spiking US National Debt continues to decline, with their combined total ($2.32 trillion) now down to a share of 8.4%, the lowest in years:

The Next 10 biggest foreign holders in December include tax havens and financial centers where US corporations have legal entities that hold US Treasuries, such as Ireland. So some of these “foreign” holders are US cash-rich corporations, such as Apple, with Treasuries that are registered in their foreign mailbox entities.

But Mexico and Germany, with which the US has the second and third largest goods trade deficits (behind China) are in 24th and 20th place respectively and didn’t make this list. The amounts in parenthesis show holdings of 12 months ago:

- UK (“City of London” financial center): $447 billion ($392 billion)

- Ireland: $315 billion ($281 billion)

- Luxembourg: $275 billion ($254 billion)

- Brazil: $259 billion ($281 billion)

- Switzerland: $255 billion ($237 billion)

- Belgium: $247 billion ($207 billion)

- Hong Kong: $230 billion ($250 billion)

- Taiwan: $229 billion ($193 billion)

- India: $210 billion ($162 billion)

- Cayman Islands: $200 billion ($238 billion)

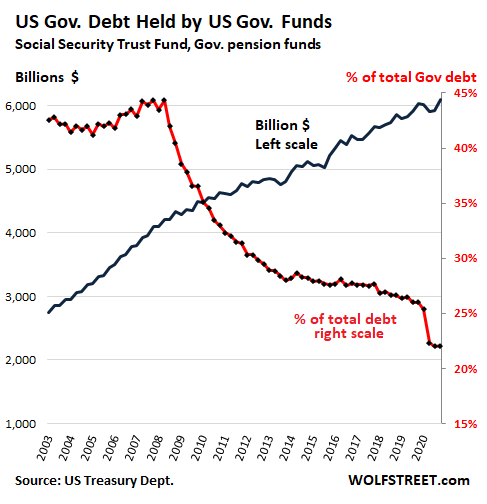

US government funds add Treasuries. But their share declines further, outrun by the Incredibly Spiking US National Debt.

The US Social Security Trust Fund, pension funds for federal civilian employees, pension funds for the US military, and other federal government funds added $178 billion in Q4 compared to Q3 and $74 billion over the 12-month period, to their holdings, now amounting to record of $6.1 trillion (blue line, left scale). But the share of the Incredibly Spiking US National Debt, at 22% same as in Q3, was the lowest in eons, and was down from 45% in 2008 (red line, right scale):

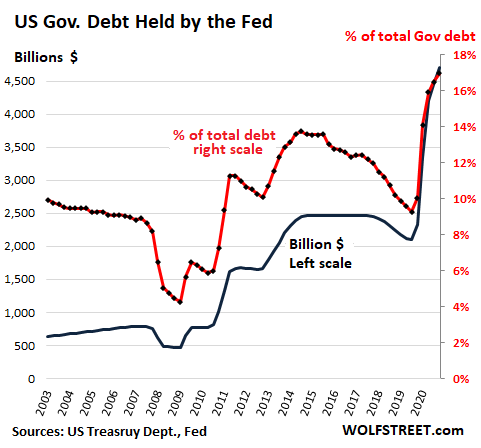

Federal Reserve monetization of the US debt.

The Fed added $253 billion to its Treasury holdings in Q4, bringing the pile to $4.7 trillion by the end of December (blue line, left scale), a record share of 17.5% of the Incredibly Spiking US National Debt (red line, right scale). Over the 12-month period, the Fed added $2.37 trillion in Treasuries to its holdings, more than doubling its pile:

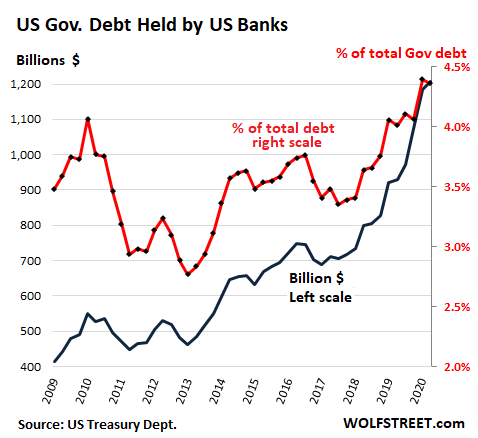

US Banks stock up on Treasuries.

US commercial banks added $24 billion in Treasury securities in Q4 to their holdings, and $277 billion over the 12 months, bringing the total to a record $1.21 trillion, according to the Federal Reserve’s data release on bank balance sheets. They now hold 4.4% of the Incredibly Spiking US National Debt:

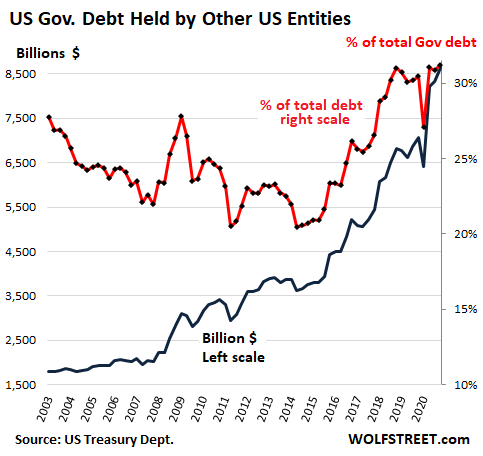

Other US entities & individuals

After all foreign-registered holders, the Fed, US government funds, and US banks are accounted for, the remaining Treasuries are by definition held by US individuals and institutions. These include bond funds, pension funds, insurers, US corporations, hedge funds that use Treasuries in complex leveraged trades, private equity firms that need to park their cash, etc.

Holdings of these US entities surged by $332 in Q4 and by $1.58 trillion in the 12-month period to a record $8.65 trillion (blue line, left scale), for a share of the Incredibly Spiking US National Debt of 31.2% (red line, right scale), making them the largest holder of that monstrous mountain of debt:

The monstrous mountain of debt by segments.

All these holders of the monstrous US Treasury debt, combined into one mountain, and color-coded for your amusement by category of holder as of December 31:

Source: Wolf Street

Most now BELIEVE debt doesn’t matter just like they believe in the tooth fairy and the mythical virus.

With MMT (Magic Money Tree) this won’t end until the currency is destroyed.

As shown in this article, the Federal Reserve has one untested tool in its monetary policy ammunition that could completely change the overall government debt picture:

https://viableopposition.blogspot.com/2020/05/deeply-negative-interest-rates.html

As an added benefit, this tool would also be a key part of creating a cashless society.

Would most people want to put their life savings into the National Debt ? Of course not – then why have all those Pensions covering the debt. I don’t ever remember anyone asking me about it – as a Shareholder. Pensions should be as far away from the National debt – as those off shore accounts of the politicians and Agency Managers are.

Expecting the Feds to send the Bailiff to the W.H. ??